Stop #29 - Private Monetary Property

Bitcoin is defined in different ways and offers different use cases depending on the contexts, but it has one constant feature: it is the best form of private property currently existing

No one spends other people's money as carefully as they spend their own. No one uses other people's resources as carefully as they use their own. So, if you want efficiency and effectiveness, if you want knowledge to be used properly, you have to do it through the means of private property.

Milton Friedman, winner of the Nobel Prize for Economics in 1976, in an interview in January 2000 described the foundations of private property. The frequent news about the seizure of movable and immovable property from Russian oligarchs, now taking place in various countries, prompted me to want to highlight one of the most important aspects of Bitcoin: the protection of private property.

The basis of civilization

One of the major vectors of economic growth and improvement of living standards is the right to private property: the concept does not only refer to real estate but to anything that is the result of human ingenuity, therefore also intellectual property or currency itself.

As Friedrich von Hayek - one of the most illustrious exponents of the Austrian school of economics - explains, in a society knowledge is distributed among all its members, it is not concentrated in the hands of a single individual. Alice has one specialization, Bob another one, Carl and David other ones. The best way to reunite and make efficient a scattered social capital is to protect everyone's private property because, Friedman adds, no one spends other people's resources with the same attention with which he spends his own.

Private property effects

Private property incentivizes productivity: people are not motivated to work if they know that the fruits of their efforts could be seized at any moment. If there is less work, there are fewer goods and services available and, consequently, living standards fall. It is no coincidence that in recent history the most significant growth in economic prosperity has occurred where private property is best protected: in the Western bloc of North America and Europe.

In many other areas of the world - China is the best known example - state control prevails over the protection of citizens' wealth, with major repercussions on the freedom and well-being of individuals. Centralization versus distribution of goods: does this remind you of anything?

Bitcoin: private monetary property

So, are there assets that embody the essence of private property better than others? Yes, if they retain their value and allow them to be directly guarded, eliminating counter-party risk.

A house, for example, can be independently protected from outside aggressors, but in the event of government seizure - unless you have a stronger army than the national one - it too can be lost.

For centuries, the asset that has protected private property the most has been gold: a valuable reserve that can be kept in complete autonomy. However, gold is inconvenient to transport and difficult to manage when it comes to significant quantities, which is why responsibility for its safekeeping is often delegated to the banks. Faced with a government's decision to confiscate citizens' gold, the government can simply knock on the banks’ doors without going through the actual owners. Giving responsibility for the custody of an asset to a third party entity means, in effect, handing over ownership of that asset.

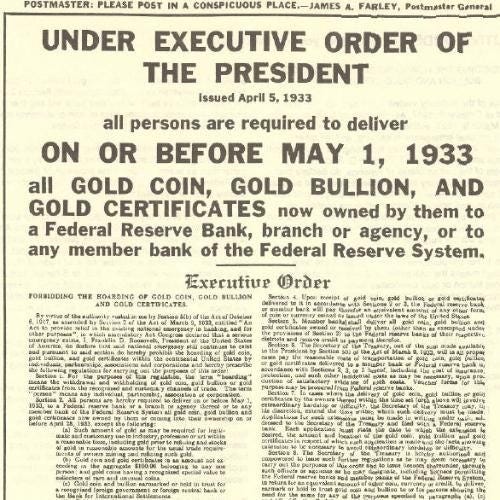

Executive Order 6102

On his P2P Foundation profile Satoshi Nakamoto chose April 5 as the symbolic date of his birthday. This is no accident.

On April 5, 1933, U.S. President Franklin D. Roosevelt issued Executive Order 6102 by which he prohibited the possession of gold by U.S. citizens. The reason behind the approval of such a liberticidal measure was that at that time a form of Gold Standard was still in force in the USA, whereby the Fed1 could not print dollars in an unlimited way, but needed a cover in gold reserves to do so. The terrible economic crisis that began in '29 was not yet behind us and the idea was that it was necessary to issue large amounts of money to restart the economy.

It was therefore decided to require citizens to sell their gold to the Fed at the fixed price of 20.67 dollars an ounce. Subsequently, the exchange rate was raised to 35 dollars an ounce. In short, the U.S. government forced the population to sell their gold at a 70% discount. Some managed to resist the forced expropriation, others obeyed, and still others were convicted for not bowing their heads.

The forced withdrawal of the Amato government

If governments can abuse their power with gold, doing so with fiat currency is even easier. By definition fiat currency is a commodity on loan, it does not belong to us. With the exception of the classic cash under the mattress, in fact, the vast majority of assets in euros, dollars, pounds, yen, etc. are held by banks on behalf of their clients: they can therefore be manipulated, seized or frozen with relative ease. To find an example this time there is no need to go overseas, it is sufficient to think about Italy.

Back in 1992, the Amato government decided to impose a 6 per thousand patrimonial tax on Italian current accounts. By means of a decree, the executive collected 8 thousand billion lire, extorting it from the citizens in order to cover the expenses of the budget law, which cost 30 thousand billion lire. Almost one third of public spending was financed through the forced expropriation of savings on which the due tax levies had already been applied and the citizens could do nothing.

Bitcoin: private monetary property

Because of the inherent characteristics of its technology, Bitcoin is the tool that to date allows people to protect their savings in the most autonomous way possible.

The vast majority of Bitcoin wallets today are represented by a sequence of 12 or 24 words known as a mnemonic seed phrase2. All you need to restore your wallet is the list of words, and everyone is free to choose how to store it: by writing it on a piece of paper, engraving it on metal plates, hiding multiple copies in multiple places, or, in the most extreme cases, simply memorizing it. The limit is your fantasy.

Of course, this applies exclusively to non-custodial wallets. Leaving bitcoins on exchanges or wallets that control users' private keys is no different from depositing money in a bank: the trust placed in third parties is similar and hacker attacks or hostile governments can steal funds without the owners' consent. That's why it's critically important to withdraw bitcoins from exchanges once they've been purchased or, better yet, not use exchanges3 at all to buy them.

To have bitcoin means to store the value of one's work in absolute scarcity derived from the earth's energy - because that's what mining is, transformation of energy into money - and to be able to control it individually by storing a series of words. There are no executive orders or government decrees that can expropriate the wealth of individuals without their consent if it is held in bitcoin.

The alternative is to store the fruits of one's sacrifices in a currency that constantly devalues - thanks to the so-called "controlled inflation" so beloved of central banks - and give control of it to third-party institutions that can be hacked or forced to give away our assets without asking our permission.

The choice is yours.

Translated by Guglielmo

HOW TO BUY BITCOIN?

Personally, what I consider as the best service is Relai. To buy bitcoin saving 0.5% in commissions you can use the code "FEDERICO".

This is an application developed by a Swiss company that applies a KYC light policy: unlike the big exchanges it doesn't require registration or personal data, all you need to buy bitcoin is your IBAN. It is optimal for setting up savings plans.

One of the best features is the non-custodial service. Euros transferred to Relai are automatically converted into bitcoin and transferred to a wallet over which only the user has control. Big exchanges, on the contrary, do not provide private keys to customers. Plus, Relai does not sell hundreds of useless cryptocurrencies, only bitcoin.

NOTE - This is NOT an advertising message. Relai is a service that I personally use and I consider one of the best on the market in terms of reliability, security and ease of use. I often recommend it to friends and family. What do I earn? What the referral code makes me earn. In this case if you buy with the code "FEDERICO" you save 0.5% on commissions and I receive (in bitcoin) 0.5% of the amount you have decided to invest.

Fed: US Central Bank.

Relai, which I usually recommend, is not an exchange. It's a service that delivers purchased bitcoins directly to a non-custodial wallet. For even more privacy I recommend the Bitcoin Voucher Bot developed by, among others, Massimo Musumeci or the peer-to-peer platforms Bisq and Hodl Hodl.