Stop #30 - The Bitcoin Pizza Day

Twelve years ago - on May 22, 2010 - the first bitcoin assets were purchased: two pizzas. History and reflections behind an event that has become symbolic around the world

It was May 18, 2010, Bitcoin had been online for a year and four months but no one had yet used it to buy a good or service.

On Bitcoin Talk - the most widely used forum for discussing bitcoin among the few experts in the field - a post by one Laszlo entitled "Pizza for bitcoins?" appeared.

I’ll pay 10,000 bitcoins for a couple of pizzas… like maybe two large ones, so that I have some left over for the next day. I like to have leftover pizza to nibble on later. You can make your own pizza and bring it to my house or order it from a courier, but my goal is to have food delivered for bitcoin without having to order or prepare it myself, kind of like ordering a breakfast platter at a hotel or something: they just bring you something to eat and you're happy!

I like onions, peppers, sausage, mushrooms, tomatoes, pepperoni, etc., just standard stuff, no weird fish toppings or anything like that. I also like regular cheese pizzas, which may be cheaper to make or buy otherwise.

If you are interested please let me know and we can work out a deal.

Initially, the post did not generate much enthusiasm, but on the fourth day, May 22, then-19-year-old Jeremy Sturdivant decided to accept the offer and had two pizzas from Papa John's delivered to Laszlo's home in Florida. At that point Laszlo posted the update on BitcoinTalk, "I just want to report that I successfully exchanged 10,000 bitcoins for pizza."

The first bitcoin price

While this may not seem like big news today, for the time it represented a historic event. It was the first time ever that bitcoins were exchanged for a good or service, which therefore also established a price per bitcoin: since the two pizzas cost $41, bitcoin was worth $0.0041.

The user who proposed the transaction was no slouch: Laszlo Hanyecz is a programmer and he is the one who first started mining bitcoin with GPUs1 when the computing power of a few laptops was still enough to write the blocks of the blockchain. As noted core-dev Jameson Lopp recalled, Laszlo made three more purchases equal to the first one, going as far as spending 40,000 bitcoins for 8 pizzas.

The lesson: Bitcoin is work

As bitcoin has grown in popularity over the years, May 22 has become the iconic day on which to celebrate the first bitcoin payment for a tangible good, Bitcoin Pizza Day.

Easy to guess the first thought of many: "Ten thousand bitcoins...think if he had kept them." Well, small spoiler, not even Jeremy Sturdivant, the guy who received those bitcoins, kept them.

The idea - unfortunately widespread among those who have recently discovered bitcoin - that it is easy and straightforward to keep one's sats2 over the years is deeply myopic. It is rooted in the sick culture of wealth to be achieved effortlessly, typical of gambling, speculative finance, and shitcoins.

On the contrary, the philosophy proper to Bitcoin's roots - whatever pseudo-economists with dubious insight may say - is quite different. Bitcoin is work: it is production of economic resources obtained through computational labor.

Bitcoin teaches that value is not created by decree; it is obtained through hard work. The essence of Proof-of-Work-which allows new currency to be created through the use of hardware resources and electricity-is exactly that.

Study is work

As it happens, studying is also work: it involves the investment of time and mental energy in learning a range of information without which it is easy to make poor decisions. Again, knowledge is not established by decree but must be acquired through effort and hard work.

Therefore, thinking of those who bought bitcoin for a few dollars - perhaps holding on to it over time - as lucky people who got rich with little effort is misleading. Until a few years ago bitcoin was an insider's tool: knowing about it meant having already acquired relevant computer knowledge and thus frequenting very niche forums and circles. And even being part of this small circle it was almost impossible to understand what Bitcoin could become: Laszlo Hanyecz and Jeremy Sturdivant are living proof of this.

Holding 10,000 bitcoins was not unusual in 2010, but most of those who had them later sold them when the price doubled or tripled: they had not yet understood the revolutionary nature of it.

We today cannot know what Satoshi Nakamoto's invention will become in 10, 20, 50 years, but we have the tools to study the technology and to intuit its implications, without panicking or getting excited based on percentage changes in the price.

HODLing: a product of study

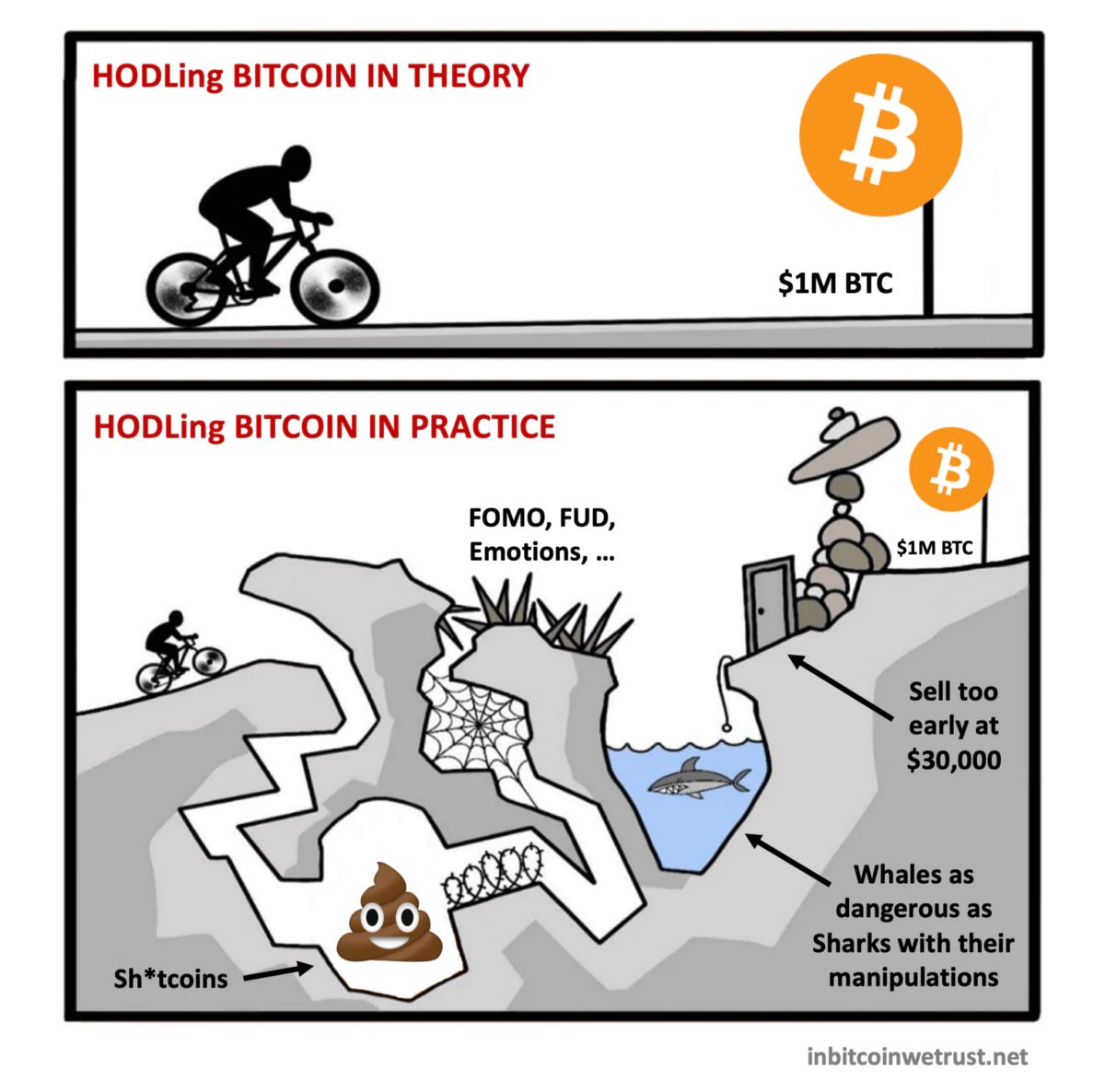

Awareness of the so-called hodler3 comes from study, thus from work. Unless one is talking about professional traders, if one approaches Bitcoin for the easy profits, the likelihood of ending up holding sats is really high.

If, however, one understands its goals, functionality and implications, that is when the idea of accumulating sats to hold them with very long-term goals - or, better yet, to get rid of worthless currency (fiat currencies)-starts to make sense.

The price of bitcoin has been subject to very high volatility and even today the percentage changes are significant, but with study - and thus with the investment of time and intellectual resources - here is where one can begin to intuit what the future of bitcoin might be and, as a result, hodlare more serenely during market fluctuations.

Accumulating sats and holding them in the long run is not "luck," it is the result of an awareness that one only matures with study, with work.

If the goal is to get rich in the short term, while also accepting the risk of becoming impoverished, turn to shitcoins.

Translated by Guglielmo

HOW TO BUY BITCOIN?

Personally, what I consider as the best service is Relai. To buy bitcoin saving 0.5% in commissions you can use the code "FEDERICO".

This is an application developed by a Swiss company that applies a KYC light policy: unlike the big exchanges it doesn't require registration or personal data, all you need to buy bitcoin is your IBAN. It is optimal for setting up savings plans.

One of the best features is the non-custodial service. Euros transferred to Relai are automatically converted into bitcoin and transferred to a wallet over which only the user has control. Big exchanges, on the contrary, do not provide private keys to customers. Plus, Relai does not sell hundreds of useless cryptocurrencies, only bitcoin.

NOTE - This is NOT an advertising message. Relai is a service that I personally use and I consider one of the best on the market in terms of reliability, security and ease of use. I often recommend it to friends and family. What do I earn? What the referral code makes me earn. In this case if you buy with the code "FEDERICO" you save 0.5% on commissions and I receive (in bitcoin) 0.5% of the amount you have decided to invest.

At the time, the difficulty of being able to write blocks-and thus earn the coinbase transaction reward-was very low because very few people engaged in mining: the few who did were using simple laptops. Laszlo increased the computational power at his disposal with GPUs by cashing in on many bitcoins. Today, with the growth of the network, it is no longer profitable to use GPUs but ASICs, specialized chips for bitcoin mining, are needed.

Sats: short for satoshi, the minimum unit of a bitcoin. One bitcoin consists of 100 million satoshi.

A term that derives from "hold" and went viral due to the mistake of a user who in 2013 on Bitcoin Talk wrote "I am hodling" instead of "I am holding." Thus, "hodlers" are those who do not intend to sell their sats but to hold them for the very long term.