Stop #31 - Ethereum's Failure

From the vulnerability of its blockchain to the centralisation of services and governance: Ethereum is the vehicle that delivers cryptocurrencies to the world of traditional finance

This stop starts with a mea culpa.

When I first approached Bitcoin in 2017, later discovering the world of cryptocurrencies, I believed for a while that Ethereum, along with Satoshi Nakamoto's invention, could also democratise the economy and make many areas today slowed down by bureaucracy more efficient.

Studying it, I changed my mind: Ethereum is a shitcoin1 like many others. Indeed it is the shitcoin, a highly centralised structure that will allow those traditional institutions that Bitcoin was born to fight - Wef2, Wall Street, Imf3 - to easily manipulate the evolution of the so-called 'crypto sector'.

The merge

Recently, Ethereum’s co-founder Vitalik Buterin stated that the 'merge' - i.e. the planned switch of the consensus algorithm from Proof-of-Work to Proof-of-Stake - could take place next August (after multi-year postponements). The idea of the conversion to PoS stems from the need to make an unnecessarily heavy and inefficient blockchain more scalable, but it will most likely lead to a very different result: it will facilitate the economic control of the network by the large financial institutions mentioned above (more on this later).

A complex and centralised blockchain

Different priorities

When it comes to distributed networks, one always has to reckon with the so-called Trilemma: between security, decentralisation and scalability, Bitcoin's blockchain gives priority to the first two, thus losing out on efficiency and speed. This is because its task is one: to guarantee the inviolability and immutability of transactions. This is why Bitcoin's Layer 1 does not support complex smart-contracts or other types of transactions that are instead being implemented on subsequent layers, starting with the Lightning Network.

The concept behind Ethereum is very different: its blockchain is extremely more complex than Bitcoin's and supports much more elaborate smart-contracts, thus enabling the development of sectors such as the now well-known De-Fi4. The point is that everything has a cost and the versatility of Ethereum's Layer 1 inevitably damages its security and decentralisation.

Few and well centralised nodes

Activating a full Ethereum node (full archival node) is much more expensive and less accessible than activating a Bitcoin node precisely because it handles several orders of magnitude more data.

While a Bitcoin full-node5 today requires only about 400 GB of hard disk storage, 2 GB of RAM and a good Internet connection, installing an Ethereum node requires 6 TB of SSD storage, 16 GB of RAM and a 2.5 MB/s download connection.

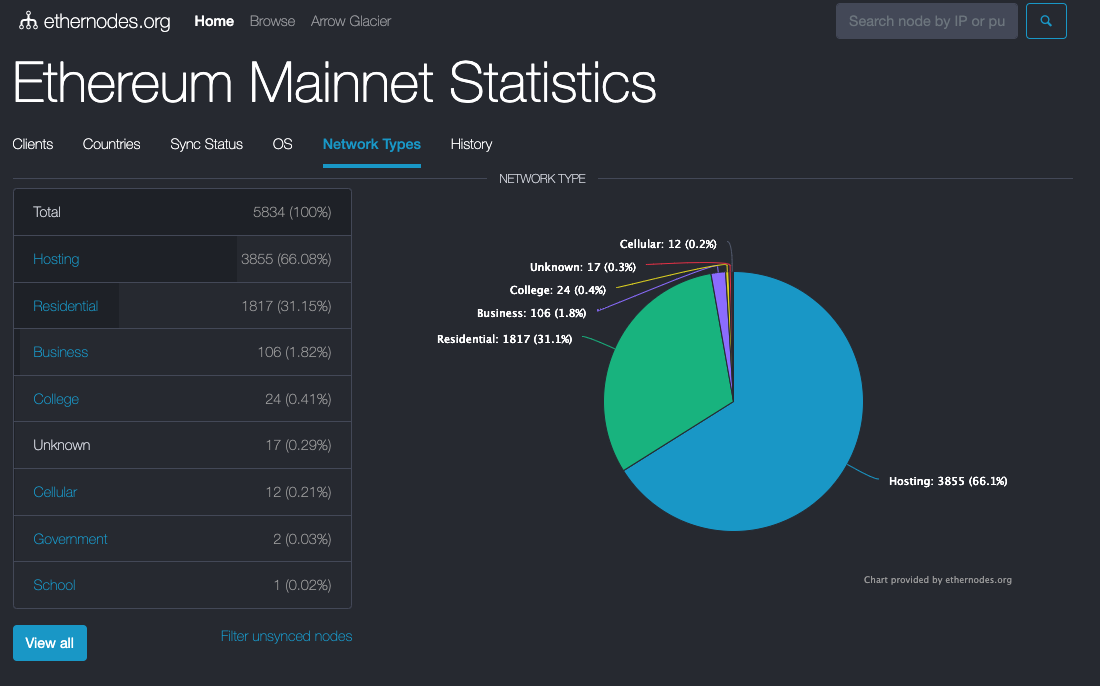

In fact, Ethereum is a less accessible technology than Bitcoin: this is demonstrated by the number of nodes in the respective protocols: an estimated 50,000 Bitcoin nodes and 5,800 Ethereum nodes are active worldwide.

Not only that: a large proportion of users are not able to install an Ethereum node at home, so they rely on centralised services such as Infura that allow them to use the protocol by relying on cloud hosting. Today, 66% of Ethereum nodes are hosted by private clouds and 43% of these are managed by Amazon Web Services.

In short, about 25% of all protocol workload globally is executed by Amazon.

Decentralisation according to ConsenSys and JPMorgan

As you know by now, the creator of Bitcoin is unknown. It is not known who Satoshi Nakamoto was: whether a man, a woman, a group of people and whether he is alive or dead.

Ethereum has two co-founders: very well known and even more influential. They are Vitalik Buterin and Joseph Lubin. The former is always very active in discussions relating to the development of his creature and has a strong voice within the Ethereum Foundation, from whose final approval practically all updates to the network pass. Interestingly enough, the foundation's executive director is Aya Miyaguchi, who is also involved in the World Economic Forum.

But it is especially worth focusing on the other co-founder: Joseph Lubin is the founder, CEO and majority shareholder of ConsenSys, a company that in 2019 acquired Infura and owns Metamask, the world's most widely used Ethereum wallet by detachment with more than 30 million active users per month (the main competitor MyEtherWallet comes in at around 1.3 million).

In fact, Ethereum's co-founder has full control of the main infrastructure that interacts with the network.

The good part, however, comes now: recently a group of 35 ConsenSys shareholders requested a special review of an agreement made in 2020 that saw the financial giant JPMorgan Chase acquire an 'influential' stake in two of ConsenSys' flagship products. Guess which? That's right: Infura and Metamask!

The dream of democratising the economy and eliminating the middleman, with JPMorgan's hand in it.

Sponsored ad

The best way to buy bitcoin is to use RELAI, Europe's easiest bitcoin app. Download it by clicking here and use the code "FEDERICO" to save 0.5% in commissions.

RELAI operates a KYC light policy: no registration or personal data is required up to a purchase limit of €900 per day. All you need to buy is your IBAN. It is optimal for setting up weekly or monthly DCA plans.

RELAI is a non-custodial service. The amount transferred is automatically converted into bitcoins and transferred to a wallet over which the user has control: not your keys, not your bitcoins.

Immutability, indeed not

"OK," you might think, "Ethereum has few nodes and its governance is centralised, but at least over the years it has proven to be a really solid and immutable technology. Not really.

The DAO hack

On 17 June 2016, a hacker found a vulnerability in the code of the historic first DAO6, stealing 3.6 million Ether7 from the organisation. A very significant amount, but these things happen in the cryptocurrency world: also in 2016, the Bitfinex exchange had 119,754 bitcoins stolen.

The bottom line is that the Ethereum community decided it was more important to recover those funds than to maintain the inviolability of the blockchain, opting for a hard-fork. The name Ethereum was assigned to the blockchain forked with the recovered funds while the original blockchain was named Ethereum Classic.

In short, the Ethereum we know today is the result of a manipulation of the original blockchain. What is the point of using a blockchain if it can be arbitrarily modified?

The transition to Proof-of-Stake

As mentioned at the beginning of the article, one cannot even console oneself with the fact that Ethereum is one of the very few cryptocurrencies to rely on Proof-of-Work as a consensus algorithm: that will also change shortly.

PoS has many problems but the most obvious is that of the control of the wealthiest because - unlike PoW, where the wealthiest have no power over the rules of the protocol - the greater the share of the asset, the greater the decision-making power over it.

This does not help when the funds are destined to end up in the hands of a few: if in Proof-of-Work the miner rewarded is who proves to have done a certain amount of work by spending resources, in Proof-of-Stake the one who proves to hold a given amount of capital invested in the asset is rewarded. The chances of writing the block, and thus earning the reward, increase proportionally as the amount in stake, i.e. invested and blocked, increases. In fact, the more money one deposits, the greater the chance of receiving it: a never-ending cycle destined to make the rich even richer and to hand over the keys to the protocol to a narrow circle of the elect. Traditional finance 2.0.

The fact that the financial manipulation of the protocol will be much easier with Proof-of-Stake can easily explain why the world's greats are riding the narrative that PoW is bad for the planet by proposing PoS as the alternative: this has been done repeatedly by the International Monetary Fund, the World Economic Forum and other large institutions of mainstream finance whose power would be undermined if Bitcoin were to spread widely.

The hands of regulators and investment funds have already sunk deep into the Proof-of-Stake regulated 'crypto world' and will be even deeper into Ethereum when it gets rid of Proof-of-Work, perhaps the only bastion of credibility and security left to the protocol.

The traditional financial world is and will increasingly be at one with Vitalik Buterin's creature and this can only mean one thing: Ethereum is what Bitcoin wants to fight.

Shitcoin: a commonly used term denoting the uselessness, if not the criminal nature, of many (for yours truly all) altcoins, i.e. all alternative currencies to Bitcoin.

World Economic Forum

International Monetary Fund

Decentralized Finance

There are various types of nodes, but the most complete node is the full-node: it is the one that allows you to keep a copy of all the data you need so that you do not have to trust any other member of the network and thus enjoy complete autonomy.

DAO: Decentralised autonomous organisation, organisation whose activities are managed by Smart-contracts.

Ether: Ethereum's native token